The tax year in Pakistan begins on July 01 and ends on June 30. The tax year 2019 started on July 01, 2018 and will end on June 30, 2019. The tax year 2019 was a highly beneficial year for salaried individuals as they got huge tax savings and had to pay minimal tax on their incomes. As the tax year 2019 is about to end, those salaried individuals in Pakistan whose tax has not yet been deducted from their taxable income will be surely interested in knowing the tax slabs for the year. They should pay the applicable tax so that they could retain their filer status and become a responsible and law-abiding citizen of the country.

The source document for knowing the tax slabs is Income Tax Ordinance, 2001. It can be accessed on the Federal Board of Revenues (fbr)’s website at the following link:

https://www.fbr.gov.pk/Categ/Income-Tax-Ordinance/326

In this tax year, the government also announced some amendments after the approval of the budget in June 2018. Hence, on the above website link, you will see two versions of the Income Tax Ordinance 2001; Income Tax Ordinance, 2001 Amended upto 30-06-2018 and Income Tax Ordinance, 2001 amended upto 11th March, 2019. You should refer to the latest version updated up to March 2019.

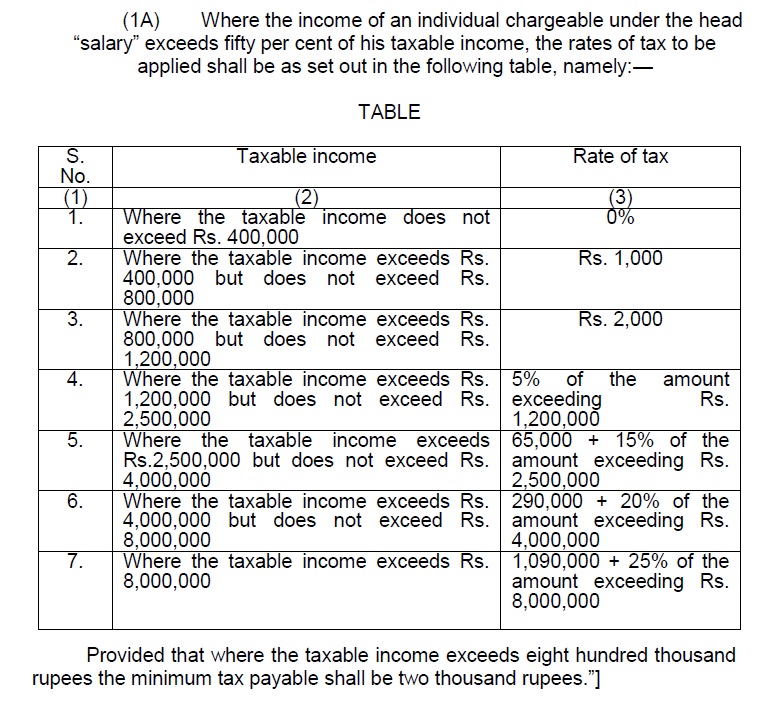

For this post, we are interested in finding the Rates of Tax for Individuals. These rates are mentioned in the First Schedule, Part I, Division I of the ordinance. You can view it in the Ordinance file on page 375. I have also reproduced the tax rates table in the snapshot below:

As an example, suppose the annual taxable income of a salaried individual is 2,300,000. The person falls into tax bracket 4. The rate of tax is 5% of the amount exceeding 1,200,000. The amount exceeding 1,200,000 is 1,100,000. Five percent of 1,100,100 is equal to 55,000. Hence, the person is required to pay an annual tax of Rs. 55,000.

All the best for your tax-filing/e-filing efforts!